What To Ask A Self-Directed IRA Company Before You Work With Them

Before you sign on with a SD-IRA company… ask them a few key questions.

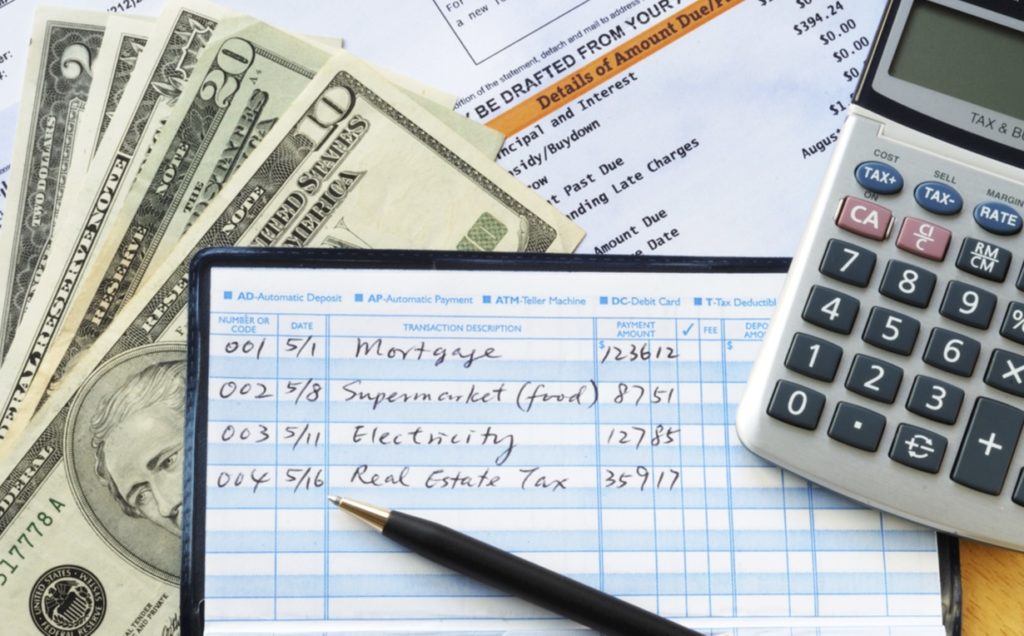

1. What are your fees? – Fees can vary wildly. Some charge an annual fee based on the value of the account, some charge an annual fee, some charge large setup fees, etc. Find out what works for you. But, the idea is that by being able to invest in real estate with your IRA… you’ll more than make up for the fees you’re paying with your higher returns.

2. What’s the process for approving an investment? – Some companies can take up to 30 days+ to fund an investment after you send it in for approval. Some SD-IRA’s give you what’s called “true checkbook control”, where you actually get a checkbook where you can write checks from your IRA account… which gives you immediate access to the funds (i.e. – to close a deal quickly). Checkbook control usually is a tad more expensive to set up than an IRA account that requires all investments to go through the sometimes lengthy custodian approval process, but again… find out what’s best for you.

3. Are there any restrictions on what I can invest in? I want to invest in real estate and make private loans. – Some SD-IRAs with larger more traditional companies like Schwab and SmithBarney put restrictions on what your account can invest in. Some don’t allow real estate… while others do. Just ask.

4. Is my retirement account eligible to “roll over” into a SD-IRA? – Not all retirement accounts can be rolled over into a self-directed IRA. Most IRAs can be… and even some 401(k)s can be. Just ask your financial advisor and ask the representative at the SD-IRA company you’re working with.

5. How long will it take for my account to be up and running and have funds available for investment? – Some people wait way too long to get this process rolling. If you know you want to use your IRA to invest in real estate… get the ball rolling on getting it rolled over into a SD-IRA account asap. Some companies may take weeks or even over a month to have your account setup complete and ready to invest. So, don’t wait until you’ve found a great real estate deal to get started… get started today so your funds are ready to invest when you need them.