- By Team

- In Uncategorized

1213 & 1215 N Spring St – Twin Properties of Oliver!

Greetings!

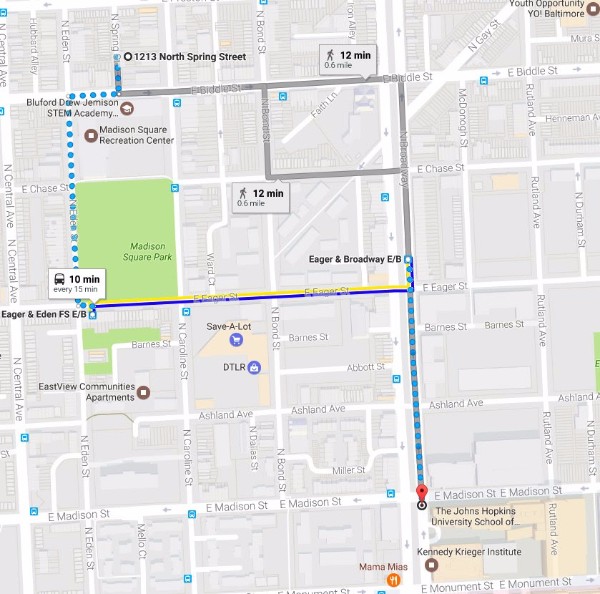

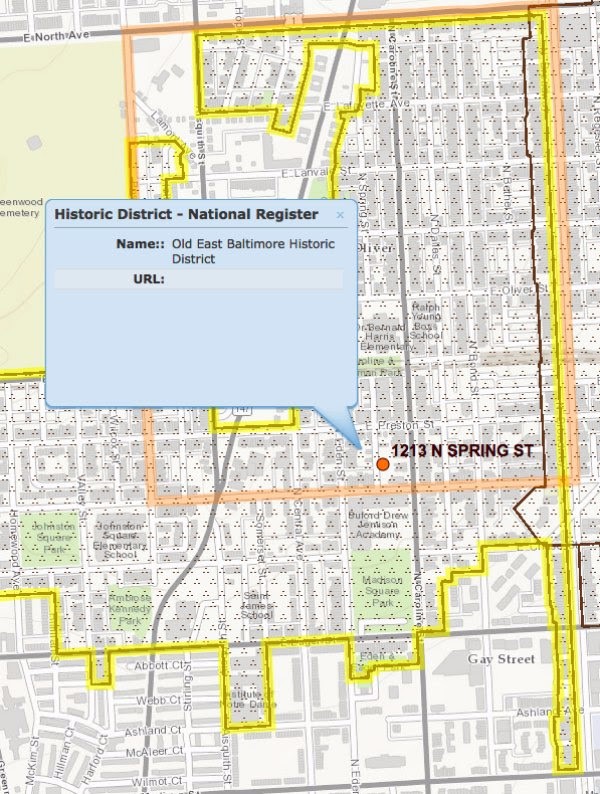

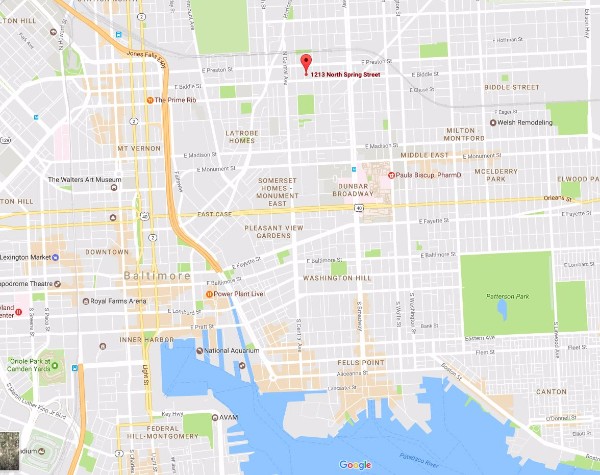

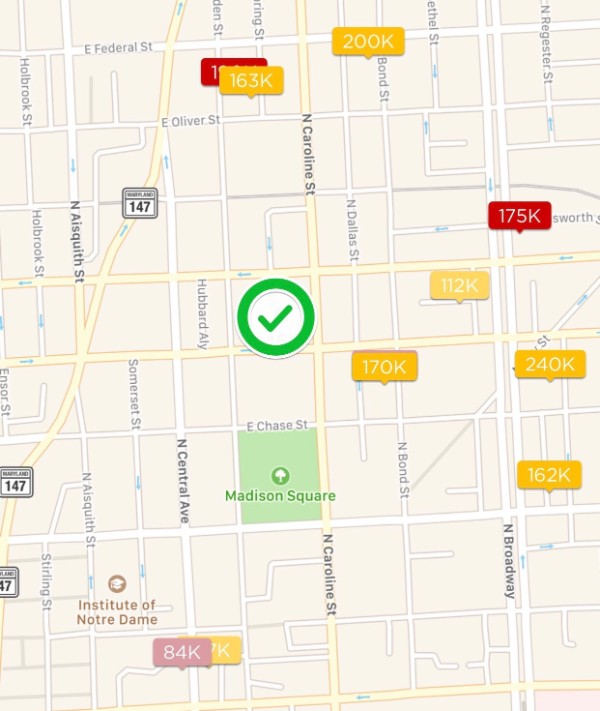

Price point is today’s topic. I speak with many of you that want to get into the Baltimore market, but some of my higher price offerings are outside your budget. So today we’re bringing you two houses walking distance from The Johns Hopkins Hospital at 80k each and comps show we’re leaving you 25k equity on the table per property as well. Buy one or both, as the floor plans will be identical. Take a peek at the neighborhood map below too … we’ve got seven churches, an Elementary and a STEM Middle School in the immediate blocks surrounding this property. All solid staples for appreciation and retaining quality tenants. As always the budget is included in the sales price to bring these properties back to new again.

Looking forward to answering your questions!

–Cris

919-675-CRIS

1213 & 1215 N Spring St, Baltimore, MD

1213 & 1215 N Spring St, Baltimore, MD 21213

2br/1ba each

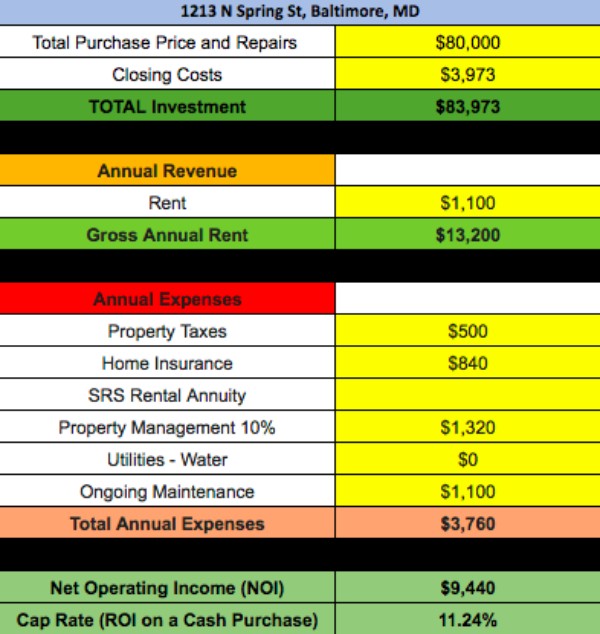

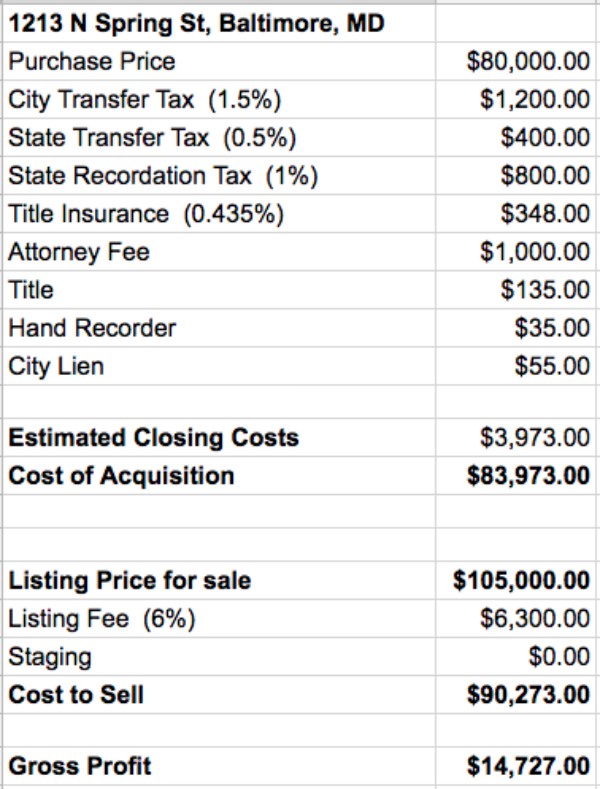

Cap Rate: 11.24% + 25k equity each

Income Analysis

Listing Price: $80,000 each

Total monthly projected rental income: $1,100/mo

Estimate Annual Taxes: $500

Estimated Annual Insurance: $840

Estimated Annual Maintenance Costs: $1,100

** This estimate is based on any potential repairs the property may need over the course of a year. In our experience, this number is typically lower, but we always estimate on the high side.

Annual Property Management: $1,320

**The fee is 10% of the monthly rent.

Annual Net Rental Income: $13,200

Annual Cumulative Hard Costs: $3,760

Adjusted Gross Annual Income: $9,440

5 Year Return: $47,200

10 Year Return: $94,400

Comps:

813 N Central Ave sold on 03/03 for 107k

1631 Hakesley Pl sold on 05/24 for 112k

635 Stirling St sold on 09/06 for 99.5k

Property and Area Photos

More About Oliver Community

Oliver ZIP codes: 21202, 21213

The Oliver neighborhood has been in the news recently, not for blight and bad news, but because the neighborhood is being revitalized with astounding speed and momentum. On a regular basis, homes are being newly-renovated and homeowners are investing in the community. Baltimore City Housing’s Vacants to Value program has seen much success in Oliver, and has changed entire blocks for the better, turning blight into beautiful new homes. Through a partnership with a non-profit organization called The 6th Branch, the Oliver neighborhood receives ongoing support from military veterans who have devoted themselves to making Oliver a safe place for families and residents to grow and live.

What’s a Pre-hab?

Pre-hab means we have not started work on the property yet. However the prices you see are our “turn-key price” that includes full rehab (granite counters, stainless appliances, hardwood floors) and we turn these around in 45 – 60 days. We also guarantee tenant placement within 30 days of completion or we cover the 1st month’s rent, should you utilize our Tenant Placement and Property Management services.

If you have your own pre-hab you’d like a construction quote on, we’d be glad to provide that for you as well.

What’s a Cap Rate?

The net income an asset produces in a given year divided by its purchase price. The capitalization rate is used to help determine the rate of return, or how fast an asset pays for itself and begins to make a profit. For example, if an asset cost $1,000,000 and it produces $100,000 in a given year, the capitalization rate is 10% and it will take 10 years to pay for the asset with the money it produces. However, it is important to note that the capitalization rate may change from year to year. For example, the same asset could produce $100,000 in year one but $250,000 in year two. It is informally known as the cap rate.